AUGUST 23, 2025

MARKET BRIEF

Jakarta Hotel | H1 2025

Jakarta Hotel | H1 2025

The Jakarta hotel market in the first half of 2025 faced a challenging period, largely driven by government budget efficiency and the decline of MICE activity. Even though there’s been a slight increase in international visitor arrivals and offline events (concerts, sports and community activities), it hasn’t offset the overall negative trends. The Ramadhan season in March also contributed to the lower demand, with business activities seeing a modest slowdown during the first quarter. Adaptive strategies such as focusing on domestic demand and capitalizing on event-related opportunities might help the market into the end of 2025.

|

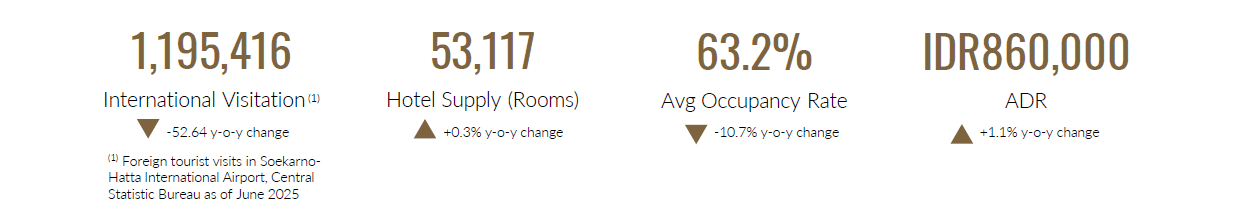

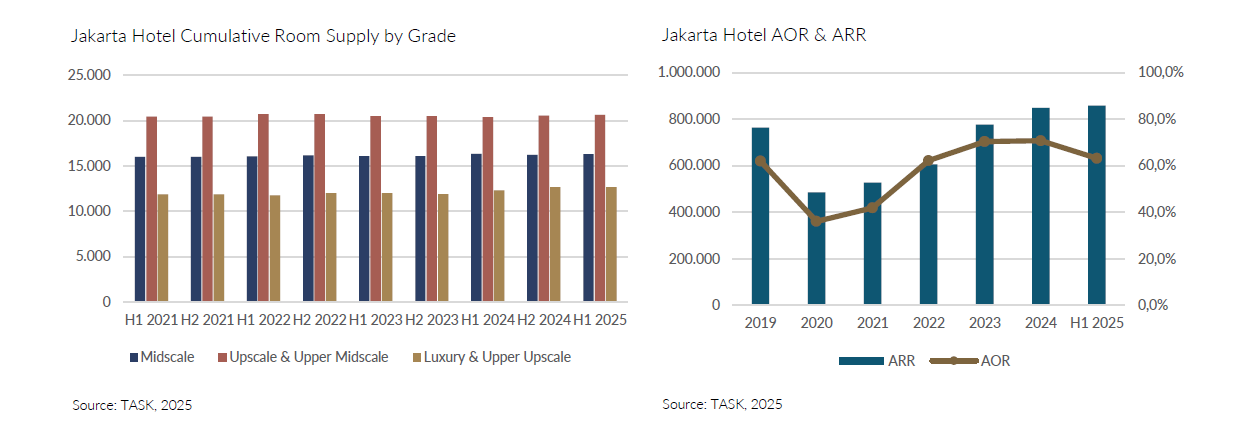

Inventory remained modest, two new supplies in the first half of 2025 totalling 159 hotel rooms

In the first half of 2025, Jakarta welcomed two new hotels, one located in Central Jakarta and the other in North Jakarta. d'primahotel PIK Jakarta (3-star) at Jl. Pantai Indah Utara, located in North Jakarta, opened in January, and ARTOTEL Hub Simpang Temu (4-star), situated in Menteng, Central Jakarta, opened in May 2025. These contributed 159 rooms to the cumulative total supply of midscale to luxury hotel rooms. Hotels in Jakarta remain largely reflecting the business-oriented market and continue to be predominantly dominated by 4-star hotels. Domestic operators have also seen reinforced their market presence. |

|

Average occupancy rates declined in the first semester of 2025

The first half of 2025 was generally quite difficult for Jakarta hoteliers; the average occupancy rates decreased to approximately 63.2%. The government budget efficiency measures negatively impacted demand for rooms and MICE space, especially in the government-related segment. Many long weekends arising from the joint leave policy resulted in Jakartans travelling out of the city, causing further reduction of MICE activities. The corporate and FIT (Free Independent Travellers) segments experienced growth, but not enough to offset the impact of the reduced government booking segment. |

|

Average Daily Rate remained stable despite the decline in demand The Average Daily Rate (ADR) of hotels in Jakarta stood at around IDR 860,000 in the first semester of 2025. This figure represents a slight increase of approximately 1% compared to the previous semester. Meanwhile, the estimated Revenue Per Available Room (RevPAR) during the same period was approximately IDR 555,000, representing a 9% decrease from the second semester of 2024. |

|

Indonesia's Cruise Sector Poised for Significant Growth

In March 2025, the arrival of the luxury cruise ship Star Voyager at Tanjung Priok Port, Jakarta, marked a pivotal moment for Indonesia’s tourism sector. As the fourth most populous nation globally, Indonesia holds vast potential for cruise tourism. With a growing enthusiasm for travel among Indonesians, opportunities are expanding across leisure, fly-cruise, and MICE segments. Industry leaders are increasingly recognizing Indonesia’s promise to become Asia’s next major cruise hub. |

|

World Expo 2025 in Osaka, Japan, from April 13 to October 13, 2025

Indonesia's participation in this five-yearly event aims to strengthen Indonesia's nation branding in the world. World Expo 2025 Osaka serves as a stage for Indonesia to promote investment, trade, and tourism, as well as to enhance bilateral relations with Japan and other countries. The Indonesia Pavilion in the expo stands as concrete proof of the nation's commitment to sustainable innovation and the circular economy. It is recorded that the Indonesia Pavilion receives an average of 15,000 to 18,000 visitors per day, or about 10% of the total expo visitors, which averages around 130,000 to 140,000 people per day. |

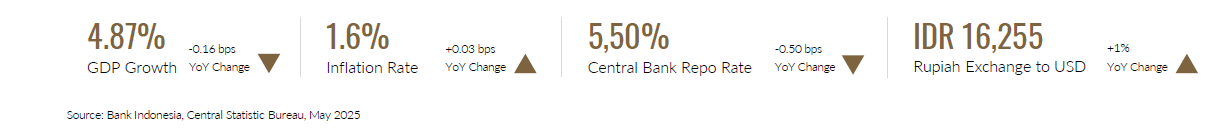

APPENDIX: ECONOMIC INDICATORS